This policy sets out our approach to best execution for our clients. It has been prepared in the context of MiFID II (the Markets in Financial Instruments Directive 2014/65/EU) and COBS 11.2A in the FCA handbook. It applies only to the execution or transmission of client orders in financial instruments, as defined in MiFID II. These orders arise from Havelock London’s discretionary portfolio management services, which are only provided to professional clients. We do not provide services to retail clients, execute client orders, or trade on our own account.

Best Execution overview

When placing orders on behalf of clients Havelock London must act in their best interests and take sufficient steps to achieve the best possible outcome for them. This is what is meant by best execution.

The definition of best execution depends on execution factors such as price, costs, speed, likelihood of execution and settlement, size, liquidity and other relevant considerations. How these factors are prioritised is determined based on the execution criteria of an order, which may vary for different clients or trades. These include the characteristics of the client, the type of the financial instrument, the size of the order, characteristics of the market and execution venues. There however may be situations where this prioritisation needs to be adjusted, for example due to exceptional circumstances such as volatile markets, or geo-political events.

Direct execution includes situations where orders are traded directly with counterparties or directly with execution venues, without going through a broker. Indirect execution occurs when an order is transmitted to a broker, who is then responsible for execution.

Havelock London acts as an investment manager in relation to equity investments, but may also make use of bond and money market instruments for cash management purposes, as well as currency derivatives for hedging purposes. Spot FX transactions are undertaken for cash management reasons, and although outside the scope of MiFID II, we still endeavour to deliver the best result for clients in all transactions.

Relationship with Northern Trust

Havelock London outsources execution to Northern Trust Securities LLP (“Northern Trust”).

Northern Trust provide us with a global dealing desk capability that can access a large number of relevant brokers and execution venues, and have in-depth trade execution expertise. It allows us to access a greater variety of underlying sources of liquidity than if we were maintaining these relationships on a direct basis. They have a best execution obligation to Havelock London, that must take into account the execution factors and criteria as agreed with us. They operate solely in an agency capacity, and provide detailed analysis of execution quality. A complete list of all execution venues that they might use is provided in the appendix to this policy.

Havelock London believe that the arrangement ensures that we achieve the best possible outcome for the execution of our trades, and undertakes an annual review of the arrangement to ensure that we continue to believe it is effective.

Execution process

Orders are communicated to Northern Trust electronically, with any unfilled orders normally cancelled at the end of the trading day. For every trade undertaken on our behalf Northern Trust will consider the execution factors and criteria above, and decide the best way to achieve the best possible outcome for Havelock London.

Havelock London’s trading activity is predominately in developed market equities with high levels of liquidity. Under normal market conditions the highest priority factor is to obtain the best result for the client in terms of the total consideration for the trade, defined as the total price obtained minus any costs or fees.

Where orders represent a high proportion of the daily volume we may split it into separate orders to be executed over multiple days if we believe it will materially reduce the implicit costs of execution from market impact. For each daily sub-order, price and cost remain the highest priority execution factors. Where it is not practical for a large transaction to be split into multiple daily orders, and the size of the order is large compared to the available liquidity in the market, the execution criteria of ‘size’ will become of critical importance. This may mean that price and cost are deprioritised to an extent and that trades may be executed in a manner that prioritises achieving a higher executed quantity.

If Northern Trust were ever concerned that an order could cause any form of market disturbance they would refer back to Havelock London before proceeding in line with their regulatory obligations and market conduct requirements. We consider this to be unlikely.

The other execution factors – listed previously – do not typically determine the way a trade is executed, although on occasion where there are specific relevant circumstances these factors may be escalated in priority.

Northern Trust undertakes the execution of trades via a number of brokers, trading platforms and execution venues that include regulated markets, multilateral trading facilities, and systematic internalisers. It is possible that they will place orders outside of a regulated trading venue, which may be subject to additional counterparty risk. They will use their expertise to asses a number of competing quotes from potential counterparties, alongside other execution factors, to decide which choice will best serve Havelock London’s interests. This could include such considerations as the counterparty’s creditworthiness, recent performance with similar orders, tenure in the market and reputation. Where Northern Trust places an order for execution on behalf of Havelock London they will ensure that, whenever applicable, the broker is under an obligation to provide best execution.

Our investment approach is long-term, so short-term market volatility is not expected to present a material risk to long-term investment performance. Where markets are particularly volatile – either in broad terms or in relation to a specific instrument – then the speed of execution may be prioritised.

Where there is an interruption in trading at a major exchange or the possibility of turbulent markets due to the failure of counterparties, then the execution factor relating to likelihood of settlement may be prioritised, along with the management, diversification and minimisation of counterparty risk.

Havelock London do not engage in cross-trades between different portfolios, but Northern Trust might do if they think it is in the best interest of both parties to the trade. Such trades will be at the market mid-point to ensure fair treatment of both parties.

Arrangements for each instrument type

Equities

We trade in equity instruments which are typically from developed markets and highly liquid. Our standard prioritisation of execution factors and transmission arrangements are applied to these trades. Although permissible in some circumstances we do not direct Northern Trust to trade with specific counterparties in exchange for research access.

Debt instruments

We trade in debt instruments that are highly liquid short maturity government bonds. Our standard prioritisation of execution factors and transmission arrangements are applied to these trades. In the UK Government Treasury Bill market Northern Trust has advised us that this is best achieved by trading in the primary auction. In these circumstances Northern Trust provides us with an indication of the likely range of yields that the auction will achieve, and we instruct them to submit an order into the auction on our behalf. The price that they submit will be set based on the average expected yield that will be achieved in the auction.

Currency derivatives

We have the ability to trade in currency derivatives for hedging purposes, but we do not expect to utilise it under normal market circumstances. We would delegate these trades to Northern Trust, applying our standard prioritisation of execution factors.

Exchange traded products

The category of exchange traded products includes exchange traded funds, exchange traded notes and exchange traded commodities. We use the same approach for these orders as for equities, above.

Non-MiFID instruments

We undertake spot FX transactions and orders in non-EEA equities, both of which fall outside the scope of MiFID II. We nevertheless endeavour to obtain the best result for our clients. We treat non-EEA equities identically to EEA equities, where possible.

Governance & Oversight

Havelock London’s Executive Committee is responsible for ensuring that internal policies and procedures deliver best execution, including: annual reviews and updates to this policy, where necessary; monitoring of order execution; and as an escalation point for any deficiencies in these procedures.

The ongoing monitoring of execution quality and ‘first line’ controls are undertaken by the Investment Management team. Members of the Investment team will sense check all trading activity on the day of trade to ensure that the price traded on all instruments is reasonable and in line with general market activity in each instrument. They will ensure trades are sent to Northern Trust in a timely manner and are realistic with respect to the typical liquidity of the instrument.

The Operations Team provides a ‘second line’ of oversight. They undertake a monthly review to ensure that broker and market charges are in line with expectations, and compare the prices achieved to measures of the prevailing market price at the time of the order. Where any exceptions or outliers are identified, these are discussed with the Investment Team in the first instance, and if necessary escalated to Northern Trust and the Executive Committee.

Havelock London’s arrangement with Northern Trust will be reviewed at least annually, as part of which they will provide us with additional analysis on their execution of our trades.

This all forms part of an ongoing approach to monitoring if the execution quality obtained is consistent with our best execution obligations.

Havelock London is aware of the requirement to use the data published by any consolidated tape providers established under Article 65 of MiFID II. At the time of writing, no such Consolidated Tape Provider exists and no relevant data had been published: therefore, no detailed procedures currently exist.

Client disclosure & consent

Havelock London’s clients are professional clients, and we consider that a copy of this policy is an appropriate means to disclosure our order execution policy.

This policy is supported by Conflicts of Interest and Corporate Inducements policies which identify conflicts and potential conflicts with the interests of our clients, including those that may require disclosure.

Note that in the case of funds, this information is provided to the fund’s management company. Investors in the fund may be provided with different information in the prospectus. It may be appropriate to share this policy with professional end-investors on a case-by-case basis, for example for a large institutional investor.

For avoidance of doubt, we do not receive any benefit for routing client orders to a particular broker, trading or execution venue; we do not receive payment for order flow; we do not apply charges or fees when executing trades or transmitting trade orders, nor do we apply charges to clients for use of different execution venues.

Client consent to this policy

Havelock London may execute some orders outside of a trading venue. Prior to commencing business with clients – including the management companies of any funds and direct investors in segregated mandates, but not indirect investors – we are required to obtain:

- written acceptance of this policy as a whole; and

- explicit written consent for orders to be executed outside of a trading venue

For fund investors who are not direct clients of Havelock London, implicit consent is assumed if they continue with their investment after receipt of the appropriate information in the fund’s offering documents.

Notification of material changes

Clients will be notified of any material changes to this policy. The materiality of any changes will be assessed by the Executive Committee as part of its policy review.

Specific client instructions

As Havelock London only acts on a discretionary basis and makes all investment decisions itself, as per the terms of the Investment Management Agreements in place, specific instructions are not likely to be received. We will always act in accordance with the investment mandate agreed with the client.

In the unlikely event that we receive specific instruction from a client as to how to execute an order it may prevent the firm from taking the steps that it has designed and implemented in this policy to obtain the best possible result for the execution.

Demonstrating best execution to clients and the FCA

Havelock London is obliged to be able to demonstrate to clients, on request, that all trades have been executed in accordance with this policy. We must also be able to demonstrate to the FCA, upon request, that best execution has been achieved. This requirement goes beyond just demonstration that this policy has been followed.

Havelock London considers that this policy, associated monitoring, reports and disclosures demonstrate our adherence to this policy and commitment to the provision of best execution.

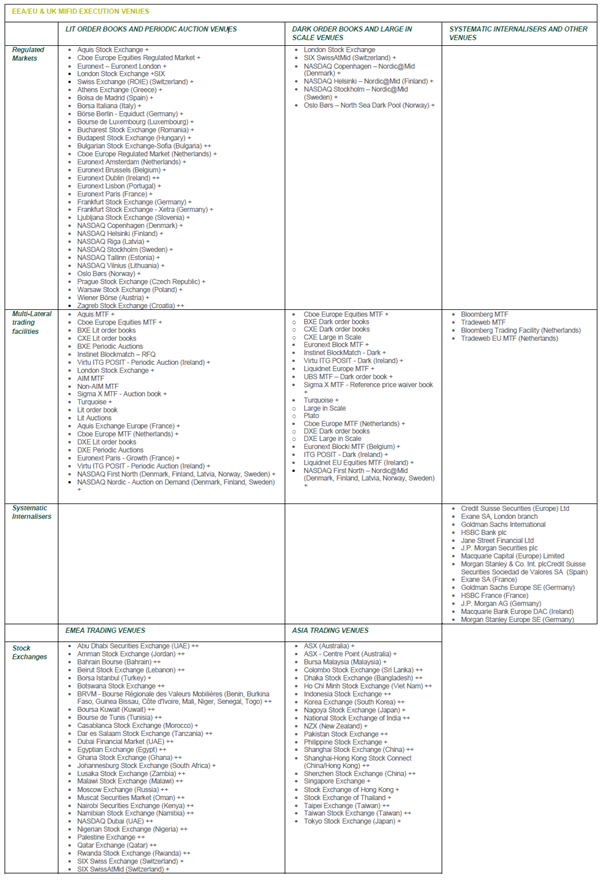

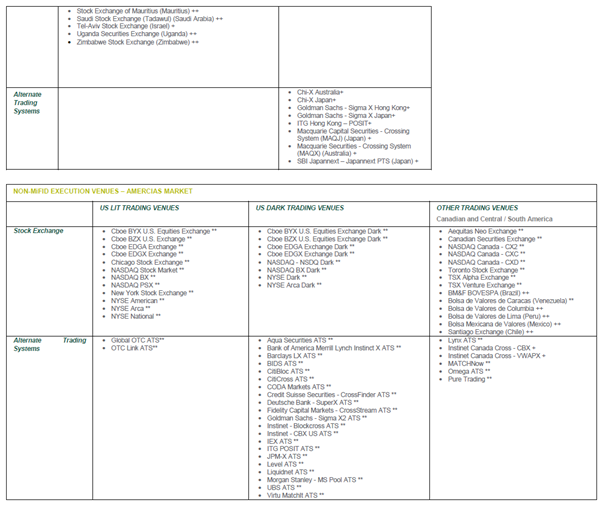

Appendix I – Northern Trust execution venues for equity and equity-like instruments

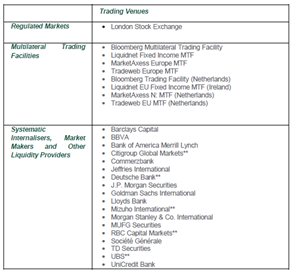

Appendix II – Northern Trust execution venues for debt-like instruments